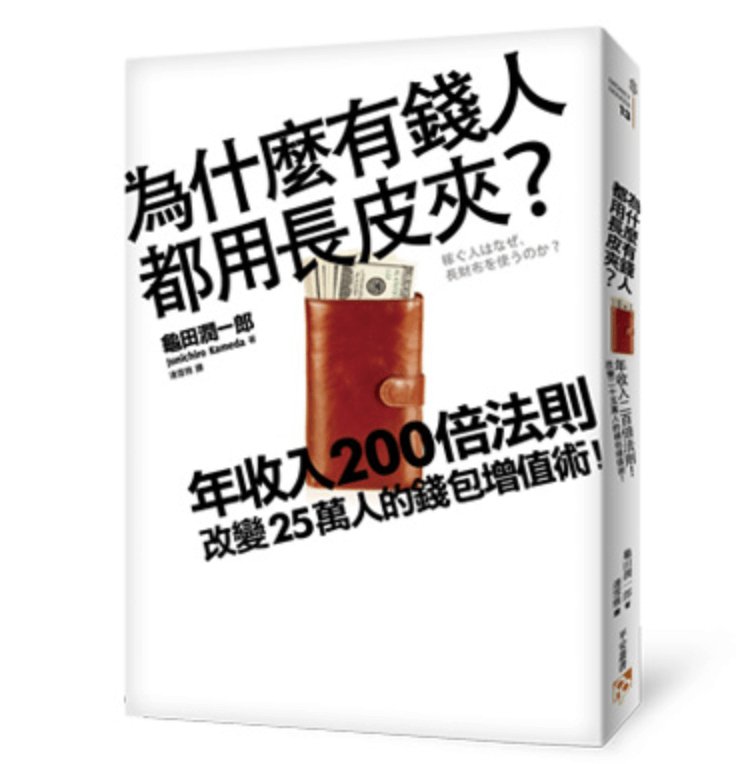

[Financial Management] Will a longer wallet make you richer? "The 200x Annual Income Rule" Change your wallet and change your life

[Financial Management] Will a longer wallet make you richer? "The 200x Annual Income Rule" Change your wallet and change your life

In a society, we often see symbols of wealth and habits. For example, rich people prefer to use long wallets. There may be deeper wealth concepts and financial management wisdom hidden behind this appearance. Let’s explore it in depth together.

1. Concept of wealth and portrayal of life

It reveals the current living conditions of poverty and poverty, shows the gap between the concept of wealth and real life from individual cases, and explores the impact of social environment on personal economic development.

2. Financial wisdom and practical suggestions

-

The power of delayed gratification

- Explores the concept of delayed gratification and presents practical examples of the importance of accumulating small amounts in life.

-

Good wallet management

- The long wallet is used as a symbol to emphasize the necessity and methods of managing money and avoiding expenditure loopholes.

-

Accounting and understanding cash flow

- Drawing from Rockefeller's approach to money management, the importance of bookkeeping is emphasized in understanding finances and building wealth.

By exploring the concepts and wisdom behind rich people’s preference for long wallets, we may be able to better understand the acquisition and management of wealth, and integrate these wisdom into our own lives, thus creating a more solid foundation for personal finances. .

In today's society, many people pursue their dreams and work hard, but still find it difficult to escape poverty. This phenomenon is particularly obvious in Japanese society. A series of documentaries have exposed the living difficulties and financial anxiety of the bottom class of society, making us ponder why, even if they work hard, some people still become "working poor"?

Take the true story of Ryoko Koyama as an example. His struggle was full of setbacks and hardships. In such a social environment, it is difficult to find a stable job even if you work hard, which makes people deeply aware of the cruelty of social reality. His story reflects the young people caught in the cracks of society. It’s not that they don’t work hard, but they face the employment reality of low wages, instability, and long working hours, and it is difficult to obtain corresponding rewards.

In this social context, financial management has become particularly important. A book titled "Why Do Rich People Use Long Wallets?" "The book puts forward a thought-provoking point of view: "Change your "wallet" = change your "life." This concept treats the wallet as the home of money, reminding us that every wallet owner needs to check it from time to time. conditions within your wallet to avoid falling victim to spending loopholes.

Why do rich people choose to use long wallets? This is not just a fashion choice, but a symbol of financial wisdom and life philosophy. It is mentioned in a Japanese best-selling book that "according book" is the cornerstone of wealth education passed down by billionaire Rockefeller to his children. He emphasized that "there is no such thing as a free lunch" and taught his children how to understand every expenditure and develop the habit of reasonable spending through daily journaling.

In order to accumulate wealth, people should master the small steps of "1 don't need 2". Delaying gratification and converting the latte factor into rational consumption is the first step to accumulating wealth. At the same time, good wallet management is also crucial, so that your money has a comfortable home and avoids your wallet becoming a hiding place for unnecessary expenses. Finally, keeping accounts and understanding cash flow are effective means to achieve wealth accumulation. Just like Rockefeller, this habit helps break the myth that "you can't be rich for more than three generations."

Revealing "why rich people choose long wallets" is not only a fashion choice, but also a profound understanding of financial wisdom and life philosophy. In this ever-changing society, understanding this wisdom may allow us to better face challenges, realize our dreams, and stay away from the haze of poverty.

Most people who value money understand their position and attitude towards money. In other words, they often think about how their money is used to make them happy.

In the past, when I was still using a bifold wallet, a certain boss who valued wallets and money once said to me, "If you use that kind of wallet, how can money come close to you? You must use a long wallet!", "Put the money away" It’s too pitiful to put it in a folding wallet!” and so on.

At that time, I only regarded money as a simple item, so I didn't have any special feelings about what the boss said. However, after actually using the long wallet, I can understand why he said that.

A long wallet is a very comfortable place for money, especially banknotes.

If you get new banknotes, you can keep them in their original shape by putting them in a long wallet, without having to fold them in half and put them away randomly.

In addition, many men will tuck a fold-up wallet into the back pocket of their pants. However, if the wallet is long, it will be very inconvenient when sitting down. Therefore, there will be no situation of "putting money under your butt" (sometimes you will see young people fastening their long wallets with chains and just sitting with them stuffed in their pockets. That can be regarded as sitting with money under their butts.) Let the wallet curve to the "shape of your hips" (it's better not to do that).

The wallet I use now is the same LV "TAIGA" series that my wife gave me. Of course, I can't still use the same wallet until now.

However, when I buy a new wallet, I always choose the same style. Even when people I know or friends ask me, "Which one should I choose if I want to change my wallet?", I will recommend the one I use without hesitation.

Because I think the texture and atmosphere of this wallet are the most comfortable space for money.

The wallet is like a hotel where visiting money stays.

If you were to stay by yourself, would you choose an old hotel with dirty walls or ceilings, or a first-class hotel with comprehensive services and beautiful scenery?

To me, money is like a super VIP guest. For the money that finally comes to me, I must treat it well. I think that the best space to make money feel comfortable is the long wallet of "TAIGA".

And I also secretly hope that these super VIPs who have received sincere hospitality will "want to visit again."

Having said that, these are just my imagination at best. Therefore, you do not have to use LV’s “TAIGA” wallet. As long as you think it will be a really comfortable space for the money, you don't have to focus on the brand or manufacturer.

However, next time you want to buy a new wallet, please remember the "200 times annual income rule" and pay close attention to the price of the wallet.

The same goes for when you want to give a gift to someone who is important to you. If you want your partner to make a lot of money, please choose a long wallet based on this rule.

Of course, if you are satisfied with your current annual income and feel that it can be maintained at the same level in the future, you can just choose a wallet that meets the annual income amount. However, if you want your annual income in the future to be higher than now, you need to purchase a wallet that meets your target amount.

When setting goals, it’s best to set them to a level that you can’t even imagine now. Assuming that the current annual income is 3 million yen and the future annual income is expected to be "purchase price of the wallet × 200 = 20 million", it is not an exaggeration to buy a wallet of 100,000 yen. Even more, the higher the price of the wallet, the better.

However, in fact, for someone with an annual income of 3 million yen to spend 100,000 yen to buy a wallet, it actually requires a little impulse.

However, the moment you get the wallet, your "will" will also change towards your future goals. In the future, the annual income will definitely be close to 20 million, which inspires a firm intention that has never been seen before. Then, start taking actions that are consistent with your goals. I also think about money all the time.

Think of this as an investment in the future, don’t you think it’s very valuable?

You can tell your income just by looking at your wallet! "The 200x Annual Income Rule"

One of the reasons why I believe so much in the power of wallets is a magical rule related to wallets.

That is the "200 times annual income rule."

The number "purchase price of wallet × 200" is exactly the owner's annual income (or disposable income if he is an operator).

For example,

If someone uses a 200,000 yen wallet, his annual income is 40 million yen.

If someone uses a wallet worth 100,000 yen, his annual income is 20 million yen.

If a person uses a 50,000 yen wallet, his annual income is 10 million yen.

If someone uses a 30,000 yen wallet, his annual income is 6 million yen.

Like this and so on.

Of course, the numbers may not always match up exactly, but after looking at the wallets of so many big bosses, I found that basically everyone’s annual income is equivalent to 200 times the price of the wallet he uses.

So, is this the same for you? Is your annual income also at this level?

Maybe, the wallet you are using now does not allow you to earn the annual income you deserve in line with this law. However, you still have the opportunity to make your future income change according to this rule.

In other words, a person with an annual income of 3 million yen currently can increase his annual income to 10 million yen as long as he uses a wallet of 50,000 yen. On the contrary, if a person with an annual income of 20 million yen uses a wallet of 30,000 yen, his annual income in the future may drop to a level that only meets the requirements of a 30,000 yen wallet.

I can't yet come up with a logical explanation for this law.

However, judging from the relationship between wallets and the owner's annual income that I have seen in the past, there is indeed a tendency of "wallet price × 200 = annual income".

However, the biggest feeling that these experiences gave me is that the attitude towards the wallet will be faithfully reflected in the attitude towards money. And your attitude towards money will be reflected in your attitude towards other things.

People who value money will also value others, information or items, and their own company's goods and services.

After this virtuous cycle, it will eventually be given back to you in the form of money. Doesn’t this fulfill the law that wallets will affect annual income?

Therefore, if you want to change your current self, or want to increase your annual income, I think you should start with the starting point of "changing your wallet."

When you change your wallet, your life also begins to change.

Don’t just think of your wallet as a tool to hold your money, think of it as a tool to help change your relationship with money. To put it more plainly, please try to think of your wallet as an item that can improve your awareness of money, and then choose a suitable wallet based on this idea!

As a result, you will find that your behavior changes.

"Since I'm using such a good wallet now, my income should be better in the future, right?"

"After switching to a 50,000 yen wallet, my annual income may become 10 million!"

It is enough to have this mood at the beginning. Once you embrace this mood and have this awareness, you will start to take appropriate actions for yourself.

Anyway, please give it a try!

What is usually just an accessory you take out with you can become the best helper to improve your fighting spirit and even change your future.

In fact, based on Taiwan’s annual income, this rule also applies!

If you use a wallet with NT$10,000, your annual income will be NT$2 million;

If you use a wallet worth NT$50,000, your annual income will be NT$10 million!

By analogy, you can also set your own annual income goals!

The Big Wrong Way to Use Your Wallet

Just like "face reading" or "palm reading", there are also so-called "wallet readings", and each wallet has its own unique expression.

Some wallets are so beautiful that they sparkle, but others are so worn that they are discolored. Some wallets feel smooth and shiny, while others are dented and deformed.

Everything depends on how the owner uses it, and the appearance of the wallet can change in various ways.

However, your wallet face will be seen by people around you without you realizing it.

In the past, when I went drinking with customers from work, I heard the conversation between Mama-san and other operators of a high-end hotel, which made me feel deeply about this matter.

Although these operators have contacts with each other because of business cooperation, the economic benefits will be directly affected by the different objects of contact. Therefore, they often unintentionally develop the habit of judging "people who attract money to them = people who make money."

When it comes to the factors that determine whether the other party can cooperate, these operators all said in unison that it is "how to use the wallet."

It is offline, bulging due to being stuffed with invoices, and losing its original color... It is difficult for such a wallet to have the charm of attracting money in appearance.

Especially the usage method of "keeping the business card in the wallet" is a typical example.

The original purpose of a wallet is to store items directly related to money, not a place to put business cards. Business cards should be put in a "business card holder". It is rude to hand a business card that is slightly stained by money into the other person's hand.

How can people who lack this kind of considerate mentality build good relationships with others in business.

As such, how a wallet is used directly projects onto the owner's earning power.

Just like the people around people with different faces will not take the initiative to approach, the wallets and money of people with different wallets will not take the initiative to approach. Believe it or not, the wallet you own affects how those around you view you.

"Appearance accounts for 90% of the influence." As this saying goes, please pay close attention to how the wallet you use will look in the eyes of others.

Collecting point cards is a "money loophole"

In order to avoid "getting fat" in your wallet, there is something you should pay attention to. That is, don't keep the point collection cards.

As long as there is one more card, the thickness of the wallet will increase. The sandwich leather on which the card is placed will also be stretched and damaged.

The trick to slimming down your wallet is to get rid of unnecessary items whenever possible. Therefore, collecting point cards has become "the first thing that must be discarded" for me.

In order to practice this thoroughly, I only have one of the most commonly used point collection cards on hand.

When you buy something with that card at Big Camera, a large electronics store, points will be accumulated to Suica (1) "Big Camera Suica co-branded card". The accumulated points can basically only be used to offset tram fares.

Sometimes I would go to a video rental store to rent DVDs. At that time, I had to use the point membership card, but I would only use it once and then throw it away. Wait until the next time you go to rent and apply for a new card.

Although this means you have to pay a membership fee every time you rent a DVD, I still insist on not keeping the collection card.

Not only do you not want to make your wallet thicker, but you also want to control your money as much as possible.

The advantage of collecting point cards is that you can accumulate points when shopping. When a certain amount is accumulated, you can exchange them for other products or use them instead of cash.

But on the other hand, the disadvantage of collecting point cards is that it will make you and I lose our thinking ability and unknowingly buy things we don't need.

"The point expiration is coming soon, go shopping quickly to use up the points." "Today's points will be doubled, so let's go by and buy something." Like this, you buy things you don't need just for the sake of points, or even if you are right in front of you. If there is an electronics store, I still take a long way to go shopping at the exclusive electronics store that collects point cards.

In the end, he was led by the point card.

Stores that issue point cards set points accumulation rules and deadlines in order to increase returning customers and customer unit prices. Many people fell into the trap.

This simply cannot be called control over the use of money.

The difference between those who can keep money and those who cannot keep money lies in the "control over the use of money", which will be explained in more detail later.

If you are constrained by a point card to make purchases, you will not be able to control the use of money on your own, and you are simply being controlled.

In fact, I am a person who is more susceptible to the temptation of collecting point cards than others. In the past, when I had several cards in hand, I just wanted to go to Amazon (2) I can finish what I ordered, but I have to spend time and transportation expenses just to buy books or DVDs from stores where I can use point cards.

Of course, if you spend time and energy to shop in stores, you will indeed make new discoveries that cannot be obtained by online shopping, but the losses caused by insisting on collecting point cards far outweigh these. Therefore, unless it is necessary, such as collecting points cards from supermarkets where you often buy daily necessities, it is better to only keep the minimum number of cards.

Remember! Don't be led by point cards. In order to control yourself from being deceived by the immediate benefits if you are not careful, please remind yourself "Don't keep the point card."